The Cost of Waiting - Which Ads should B2B marketers scratch and scale post COVID-19?

When trying to explain to B2Bs why they need to invest in their data infrastructure to understand attribution, we’ve often found ourselves referring to the old Chinese proverb:

The best time to plant a tree was 20 years ago 🌳 The second best time is now.

No further back than November of last year in this post we wrote the following:

What will you do when all low hanging fruit is gone or a recession strikes or your company goes from growth to profit focus?

You will have to be able to confidently show exactly which activities to keep and which activities to scale.

Little did we know that this statement would become vibrantly relevant not 6 months later. The Cost of Waiting is starting to show.

The time is now

A recession is lurking. All across the globe the vastly spreading CoronaVirus / Covid-19 has put a halt to business as we know it.

For some businesses this means a surge in requests, but for the larger economy, dark clouds are gathering. Tough decisions are waiting right around the corner.

Reflecting on Sequoia’s recent note Coronavirus: The Black Swan of 2020 on how to act as a business during this period Gené Teare from Crunchbase notes:

Allow us to interpret the above quote from Gené Teare:

It’s time to focus on the activities that drive revenue - and to shut down those that do not provide a direct impact on revenue.

The Cost of Waiting is the price you now have to pay for having to make decisions on incomplete data in these times of rapid change.

B2B Data for Decision Making

Across the globe, across most industries, B2B marketing and growth leaders must now start to line up the business cases for decision making.

For cost-cutting. Decision making. Re-focus. Spend freeze. Growth quarantine. Call it what you want.

In this situation, there’s nothing more dangerous than bad data. Is your B2Bs data ready for it?

Here’s some self-diagnosis scenarios that you can consider:

At best, you’ve already been storing relevant data about what makes revenue happen for your company for years. Everything from user-tracking data, ad spend and crm records are just laying around in a database waiting for proper analysis.

Alternatively, you have enough data for a period long enough for proper decision making ie. somewhere close enough for you to know your average Time to Revenue.

If your answer to the first two scenarios are no, then your data foundation for B2B decision making might be unfortunately weak.

However there could be one last hope for you.

If you’ve been using a Customer Data Infrastructure Platform, like Segment, you might be able to replay the historical data you need to be able to make decisions from an enlightened perspective.

If the answer is still no, then there’s no two-ways around it. Bad data correlates with bad decisions and you are ill-prepared. You’re in a situation where you need to act and the data you need to do so is not in a good state.

What might look like a good plan you want to act on, can be a bad decision in disguise.

The reason for this is that the tools most B2Bs use are not built to describe what’s going on in a B2B context;

Long time from 1st click to revenue

Multiple stakeholders

Sales as a result of team efforts,

And people today are now using a herd of devices

That’s some of the reasons why the traditional tools for tracking and analyzing B2B data can’t be trusted.

If we are not to be too pessimistic, perhaps there are ways to recover some historical data from some platforms you use. Reach out to us and we will be happy to discuss options with you.

But do take one learning from here before proceeding:

Start storing your own data.

Here are your strategic alternativea

Let’s now turn our attention to where you could go from here.

In times where a recession could be lurking, most businesses have 4 options to choose between:

Do nothing and see what happens.

Wait it out a bit. See whether there are any changes in demand.

Panic. Shut down spend completely.

Halt all activity. Start listing who to fire first. Throw away all expansion plans.

Default to profitability.

Focus on what directly impacts revenue. Run analysis of every business function. Start to optimise what could be doing better. Scratch the worst projects. Start off a few projects, inspired by current profitable campaigns.

Scale spend to conquer market shares.

As many of your competitors will have picked one of the above tactics the decreased demand for ads exposes an opportunity for the brave. More on this in a bit.

Scale ad spend during a recession, really?

In a recent piece for Marketing Week, Mark Ritson reflects on historical learnings from whether or not to advertise during recessions.

Somewhat surprisingly studies suggest that most companies, in all sorts of different recessions, the winners are those companies that maintain or even increase ad spend during recessions.

Continuing to invest in marketing sets a company up to survive the downturn (a little) and then prosper (a lot) in the period that follows.

Reasons for this being:

Ads have both short and long-term effects. These longer-term effects can take several years to fully manifest and they are largely invisible in the immediate, inherently short-term metric called ROI.

Less able marketers will now cut their ad budgets because their boss told them to or because they actually think that the savings from killing a campaign will be superior to any impact that advertising would have generated.

By maintaining ad budgets at current levels this year and next, the same investment will have a much greater impact because competitors have either gone bust and stopped advertising or reduced their ad spend significantly – see point two.

Ramping ad spend back up when the recession ends is relatively pointless because (and I refer you back to point one above) it takes time for advertising to achieve its ultimate, longer-term effects.

Oh yeah. Finishing off Mark Ritson adds:

Unfortunately, to pull this off you require three things:

1. You need to have some money available to spend on advertising.

2. Then you need an executive team smart enough to know marketing is an investment or trusting enough to listen to your presentation that explains all of this to them.

3. And, finally, you need to not be shit.😄

Acting on Dreamdata

Enough theory for now. Let’s look at how three Dreamdata customers potentially could make decisions around their B2B ad spend. The process has the following three steps:

1. Time to Revenue:

Before acting or analysing any ad spend data, the first thing you want to make sure is that you’re basing your decisions on correct data.

A vital component in the equation is to know your company’s Time to Revenue.

How long does it take from an accounts very first touch until the whole account is closed as won?

2. Ad Channels:

Determine where you spend the most on ads and currently has the biggest effect on your revenue. You want to make sure you act on the channels that have the most impact first. That said you should always try to optimize everything you can.

3. Campaign Roas:

When you have identified the channels that matter the most, drill down to the campaign level.

When it comes down to it, what matters about most ads is that they hit the Return on ad Spend (Roas) that you have agreed to aim for across your company.

If you sustain ads with a poor Roas you need a good explanation.

If you have ads performing better than your targeted ad spend; hurry up and buy more traffic from that campaign!

Company 1

For Company 1 the Time to Revenue looks to be 90 days or more.

The reason we say “or more” is that the curve keeps trending towards the top right corner. This indicates a correlation between the time that Dreamdata have been collecting data and the average customer journey keeps increasing.

Only upon seeing a consistent Time to Revenue curve can the company fully know their average customer journey.

The +90 days Time to Revenue insight is now utilized to set the Ad Cohort inspection as the time frame is set for October through January.

This means that the ad spend have had a fair chance to prosper into revenue hence can now fairly be judged as working or not.

From the Ads overview it’s clear that this B2B company spends most of their ad spend on Google Ads. Let’s jump to inspect these below.

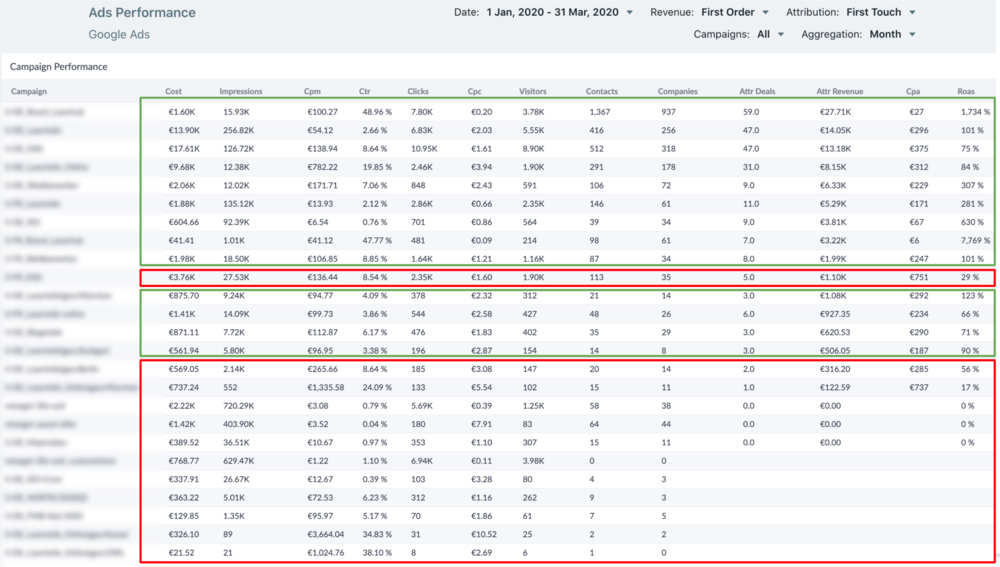

In the image below you can see the performance of Company 1’s Google Ads.

The way we do attribution at Dreamdata is by linking the unique click id’s to contacts who again are linked to accounts.

In this way, you’re able to confidently say e.g. that this click on this campaign were part of a won accounts customer journey.

By now Company 1 are looking at a Roas 86% on their four months cohort, if you inspect the data with first touch attribution model.

Does that represent the full picture? No.

But this company know that their customers, on average, stay for around four years. So when you after 6 months are already close to hit Roas 100%, then Company 1 can most likely comfortably raise spend on the ads that led to this performance.

So far, so good. But COVID-19 is here and many business leaders are looking to cut some immediate spend.

Often times this means a request from management to reduce ad spend immediately as it has a strong short term effect (while it might be a wrong decision long term).

Say you have been told to scratch 50% of the budget, where would you scratch it?

In our world it should always come down to Roas. Whether or not the campaign is meeting the demands to Roas set forth as it was created.

Everything that’s above target = Scale.

Everything that’s below the Roas target, these you can consider to scratch.

Simply put “Bad Campaigns” are campaigns with Roas below 50%.

“Good campaigns” beats your Roas target. For Company 1 their ads actually looks very decent:

With 50% Roas target in hand you can start to summarize your campaigns and understand how your B2B ad campaigns are really working for your company.

24% of the current budget that can be reinvested in new growth. Nice. And actually a quite good current performance as well.

With the explanatory details of the Company 1 walk-through we can be a bit more direct trying to understand the Cost of Waiting for Company 2 and 3.

Company 2

Company 2 has one of our customers shortest Time to Revenue: +35 days.

The +35 days Time to Revenue means we (at the time of writing) can inspect their Google Ads data from January until March.

From our talks with the company we know looking for a Roas 70% on their First orders. So off the bat the ad performance looks good.

This impression continues as we start analyzing the Good vs. Bad Campaigns.

Only 19% of their ad spend looks to not hit Roas. Impressive.

As most of the campaigns below are marked green, the discipline for Company 2 should more be to look at which campaigns it’s possible to acquire more traffic from.

Then later, they should of course have a look at Bad Campaigns to see if they could be optimized or if they should be shut down.

Normally the Cost of Waiting analysis would stop here.

But after analysing Company 2’s revenue cohorts it does not. Instead they should probably reconsider their Roas target of 70% on First orders.

In the graph below we’re analysing how their Revenue Cohorts grow over time.

In just 1 year, Company 2 grew their revenue from these initial deals by 20x. That’s in lack of better words… Amazing!

This means that they should probably be willing to adjust their 70% Roas target.

Ie. if Roas 40% is enough they could probably keep a lot more ad campaigns running and conquer more market share from their competitors.

Company 3

Company 3’s Time to Revenue is +122 days. As the curve continues to grow significantly every month, it can be expected that we’re still far from understanding the average Time to Revenue.

For the short term, it means it does not make sense to analyse the most recent months ad cohorts.

At the surface level Roas 574% looks very impressive. But never trust data from a surface level. Let’s unwrap the 574%.

Firstly, Company 3 is not a software company, so their margins are not near the other two Companies in this analysis.

Secondly, if we assume they need to hit Roas 300% the picture starts to change. 69% of their spend has still not passed Roas 300%. Only 26 of their 404 campaigns hit the target.

The tricky thing here is that we’ve still not seen their true average Time to Revenue. Meaning the ads Roas might still rise further going forward.

Thirdly, to help the marketers at Company 3, let us examine the Revenue Cohorts to see if there can be a straw to hold on to.

Within 12 months the revenue cohort we analyse goes from $3,166,352 to $5,624,514. That’s an additional $2,458,162 in revenue equal to an increase of 78% on the First Order.

Given the short time period that has passed since the ad investment was made, the ad campaigns can be expected to increase their Roas within the time to come. This should be considered as they do the thumbs up / thumbs down exercise on their current campaigns.

Concluding remarks

A radical event like COVID-19 calls for radical thinking and awareness.

There’s always more to B2B marketing and growth data than what meets the eye. You must understand your data in the right context.

Individuals needs to be understood as part of an accounts buyers journey.

Roas on B2B ads is not seen in the month where the investment is made.

You need to understand your Time to Revenue to fairly assess performance of B2B ads.

The Cost of Waiting to get B2B data in order is now writing invoices across the globe.

The Cost of Waiting for the companies in this post is anywhere between 19% and 69% of their ad spend.

Acting on bad B2B data might lead to unwise decision making and spiral your business into a downturn.

With the right B2B data infrastructure, the moment your competitors are pausing might be the moment to conquer formidable market share.

And to conclude… The second best time to plant the tree is now. 🌳

Like what you’ve read? You might be interested in this article.