Benchmark: Google Branded Search Ads CPC Increases by 34% Over the Last 12 Months

On a routine check last month, we discovered that our cost-per-click (CPC) on Google branded search terms had increased significantly. So we went into discovery mode, and looked at the Benchmarks across all Dreamdata customers to see whether others were experiencing a similar trend.

The results were very interesting:

There’s been a significant increase in CPC

Click-through-rate (CTR) has decreased across the board

Google Branded Search in general takes up more than 7% of the B2B digital ad budget

The reasons? We can only assume.

We’ve put together an article with our findings using Dreamdata’s Ad Budget and Performance B2B Benchmark data. We explore potential causes, and explain what you can do to counteract the changes.

What we uncovered about Google branded search benchmarks

After digging around in Dreamdata’s B2B Benchmarks report, we found that overall, Google Search branded keywords are more expensive.

Let's break down the key changes we've observed in Google Search Branded Ads over the last 12 months.

Branded search takes ~7% of ad budgets

A significant 7% of Dreamdata customers' total digital ad budgets are allocated to protecting their own brand name on Google.

When this cost rises, and this is exactly what we’re seeing, it puts pressure on the overall marketing budget.

CTRs have declined by ~29%

CTR has decreased by a very significant amount, nearly 29%. This means that a substantially smaller percentage of people who see your branded ads are actually clicking on them compared to May 2024.

For most businesses, such a decline typically points to a few possibilities: your ads have become less compelling, users are finding answers directly on the Search Engine Results Page (SERP), or a combination of factors is making your ads less attractive to click.

However, with the introduction of AI and answers appearing directly on top of, or within the SERP, this could be a strong indicator of why we’re seeing this decrease. We cover this point in more detail below.

Lastly, a declining CTR can also directly and negatively impact your ads' Quality Score, a key factor Google uses to determine ad ranking and CPC.

Source: Dreamdata B2B Benchmarks report. This platform screenshot shows the month over month decline in CTRs.

Unpacking the "why" behind the decrease in CTR

The mechanics of Google's advertising auction algorithms aren’t public. As a result, we can’t write with certainty when we unpack trends. Instead, we have to speculate on the likely causes.

The shifts we're seeing aren’t driven by a single change. They are probably the result of several forces acting in concert.

AI Overviews leading to less clicks?

The decrease in CTR could be a direct consequence of Google's evolving SERP, specifically the rollout of its AI Overviews.

Previously, users had to click on a link (whether organic or paid) to get detailed answers to their questions. Today, AI Overviews synthesize information from multiple sources and present an answer appearing at the top or middle of the page.

Their search journey is completed on the SERP itself. As a result, even if your ad is in a top position, it's competing with a rich, informative answer. With this in mind, perhaps AI Overviews are contributing to the general decrease in CTR that we’ve observed.

Fewer clicks and a lower Quality Score

Think of Quality Score as Google’s “relevance” score for your ads. A huge part of that score is your expected CTR, because real-world clicks are how users “vote” for the best ad on the page.

When your CTR declines, it’s a signal to Google that users find your ad less helpful than the competition. This tells Google that your ad is less relevant, which lowers your Quality Score.

This drop in Quality Score has immediate financial consequences. Google will either start charging you more for each click to maintain your ad position (think of this as a a kind of “relevance tax”) or your ad will rank lower, leading to even fewer clicks.

CPC has increased ~34%

This is the metric that initially caught our attention and is arguably the most alarming. CPC has shot up by over 34%. So, when someone does click on an ad, it's costing over a third more than it used to.

This directly impacts your campaign efficiency and overall return on investment, especially for terms that should theoretically be your most cost-effective.

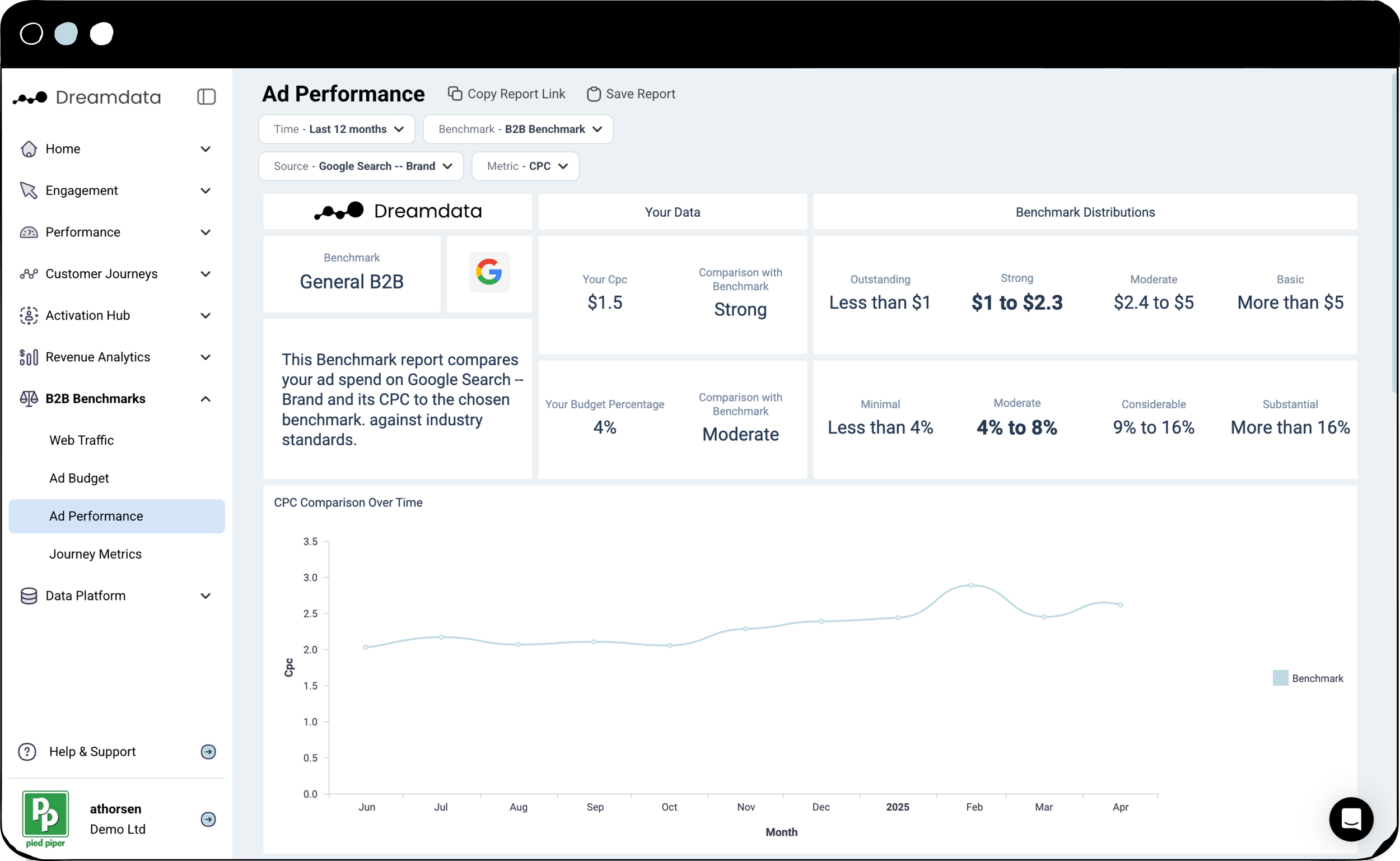

Source: Dreamdata B2B Benchmark report. This platform screenshot shows the month over month increase in CPC.

Unpacking the "why" behind the increase in CPC

One of the drivers for the increase in CPC could be a combination of overall price inflation within the Google Ads ecosystem and a shift in how competitors operate.

General Google inflation in ad clicks

What we are seeing could be, in part, a reflection of a broader market trend where the baseline cost to advertise is simply getting higher for everyone. This isn't unique to any single advertiser.

More businesses are investing in digital advertising, and existing advertisers are increasing their budgets to stay competitive.

With a finite amount of high-value ad space (especially at the top of search results), this increased demand directly pushes up the average cost-per-click in Google's auction-based system.

Increased competition on branded keywords

Perhaps more directly impactful is that bidding on competitors' brand names seems to have become a standard competitive tactic.

When a competitor bids on your brand name, they insert themselves into an auction that was once yours. This has two effects:

It forces you into a bidding war for your own traffic, directly driving up the CPC.

It aims to capture high-intent users at their final decision-making moment, siphoning away potential customers who were actively looking for you.

This can happen intentionally, as a direct strategy to disrupt your funnel, or even unintentionally, as competitors using broad match keywords are automatically entered into auctions for your branded search terms by Google. The outcome is the same: more bidders in your brand auction leads to higher CPCs.

Why are the branded search term ad costs alarming?

Why are these numbers concerning? Ads are getting less clicks (29% lower CTR). And the clicks you do manage to get are costing you significantly more (34% higher CPC). When the cost-efficiency of these campaigns is hit, it puts pressure on your marketing budget and ROI. This begs the question: what can you do about it?

Five countermeasures for rising branded search CPC & CTR

While broader trends like market-wide ad inflation are outside of your control, you do have control over your own campaign’s performance. By focusing on what you can improve, you can mitigate the impact of what you can’t.

To make this content actionable, we’ve put together five countermeasures.

1. Register your trademark and enforce it

If you haven't already, register your brand name as a trademark. This provides a stronger legal basis when reporting competitors to Google who inappropriately use your brand name in their ad copy.

While Google's policies on bidding on trademarked keywords are nuanced and generally allow it, using a trademarked brand name within the ad text of a competitor's ad can be a violation. Registration strengthens your case when submitting a complaint.

Be aware that this isn’t a silver bullet. It won’t prevent others from bidding on your brand keywords. But it will give you greater control over the use of your brand name in ad copy.

2. Maximize ad relevance & boost your quality score

Your branded ads are some of your most valuable assets. To make sure they’re working for you, regularly test out and refresh the ad copy. This avoids ad fatigue.

You can create a checklist of sorts to make sure your ad copy is making use of the relevant ad extensions. Have you included sitelinks, callouts, structured snippets, and image extensions? It there a tight alignment between the keyword you’re targeting, the ad copy, and the landing page?

The reward for continuously making your ads relevant will be reflected in your Quality Score. In turn, a high Quality Score will lead to lower CPCs and better ad positions. It won’t entirely resolve ad inflation, but you’ll at least counteract the higher costs that come with less relevant ads.

3. Optimize your branded campaign structure & bidding

Make sure there is structure to the keywords you’re targeting. How can you do this?

First, use [exact match] for your core brand terms, so you only appear for the most relevant searches.

Second, add negative keywords to filter out irrelevant searches that might include your brand name but have different intent (e.g., "reviews of [Your Brand]", "[Your Brand] stock price", "[Your Brand] jobs").

Then, review your bidding strategy. While target cost per action (tCPA) or target return on ad spend (tROAS) are common, for branded terms where you need to be visible, consider "Target Impression Share" (aiming for the absolute top of the page). However, monitor this closely against your budget.

4. Enhance your branded search landing page experience

With clicks becoming more expensive, they need the best possible chance to convert. Ensure your landing pages are highly relevant to your brand promise, load quickly, are mobile-friendly, and have clear CTAs.

If your page is fast and relevant, you’re going to improve your conversion rate. It also positively influences your Quality Score.

The point here is that you absolutely do not want your expensive visitors to have to think hard about what they’re seeing. You want to guide them directly to what they’re looking for.

5. Strengthen your organic presence for brand terms

Investing in SEO for your brand terms is one of the most sustainable ways to defend against rising ad costs. The goal is simple: for every branded search, you want to capture the click organically so you don't have to pay for it.

A prime example of this is targeting keywords like "[Your Brand] alternatives" or "[Your Brand] vs. [Competitor]".

Think about the user searching for these terms. They are highly qualified, late-stage prospects doing their final due diligence. If you don't provide a resource for them, you are forced to compete in a high-stakes ad auction for that click, often against the very competitors they are searching for.

We put this tactic into practice with our own Dreamdata Alternative domain after seeing competitors targeting our brand keywords. You should check it out. Without gloating too much, it’s pretty funny.

This page allows us to control the narrative. It’s cheaper than outbidding competitors on Google Ads, and it’s a self-sustaining organic way to capture branded searches over time.

Conclusion

Our data shows that paying for ads on your own brand name is more expensive. It’s costing more (CPC increase of 34%) to get fewer clicks (CTR decrease of 29%), and this seems to be the new normal, thanks to more competition and big changes from Google (like its new AI Overview).

While you can't control Google's algorithm, you can absolutely control your own strategy:

Register your trademark and enforce it

Maximize your ad relevance and boost your quality score

Optimize your brand campaign structure & bidding

Enhance the landing page experience

Strengthen your organic presence for branded terms

At the end of the day, it's all about being smart with your budget. Keep a close eye on your paid campaigns, but don't forget that an SEO play can do some of the heavy lifting for you.

These are our working hypotheses based on the data and current market trends. What are you seeing? We welcome your insights and will be updating this post with your perspectives. Get in touch with us at athorsen@dreamdata.io.

About the data

The data used to compile these insights is anonymised aggregated data* taken from all Dreamdata customers who have integrated Google Ads with Dreamdata (and who have not opted out of the Benchmarks).

* At Dreamdata we take data security and privacy very seriously. Dreamdata has processed only non-PII data for this study. The data insights are aggregated, and a minimum number of data points (accounts) has been introduced for every benchmark meaning it is not possible to identify individual companies. Only data from companies that have agreed to let us use data in benchmarks are included.